After 15+ years in the real estate business and many home purchase transactions, I can say with confidence that the best time to see a house is ironically the worst time to see a house. In other words, the best time to see a house is when the house is not looking its best – when its imperfections, wrinkles and warts are obvious. It’s easy to love a house when it’s a sunny, beautiful and warm afternoon, and when it’s in the middle of the day with the least amount of traffic or commuting noise. Those are nearly perfect conditions, and what house wouldn’t look great in that kind of situation? You want to see your potential new home in its worst case scenario. After all, if you still love the house in its worst state then you stand a much better chance of being happy with your home purchase.

Before we get into the meat of this topic, I have a bit of a disclaimer and a general rule of thumb about home showings. First, you can’t always control when you see a home, especially that first showing. You could be relocating to the area, and you have 10 houses to see each day for three days. Your real estate agent is setting the schedule, and so you don’t have control over the time of the showing nor do you have control over the weather or cloud cover. In fact, you’ll never have control over the latter because as we know, the weather and skies can change in an instant. But I digress…. The time of the showing, however, is something you can and should try to control, especially when it’s the second time seeing the house. Next, the rule of thumb is about seeing the home in the light of day – be sure that you do. If you saw the house for the first time in the dark, which happens frequently in the winters of New England when it’s virtually nighttime by 4:30 p.m., make a point of scheduling the second showing when it’s light outside.

Now back to the task at hand…. Let’s say you’ve had the first set of showings for a variety of houses, and you are about to see the #1 house on the list for a second time. When planning this second showing, as I mentioned above, keep in mind that it’s ideal to see the home in its worst case scenario. So for example:

If you think the house may be dark – see it on a gray day when the natural light is at its least.

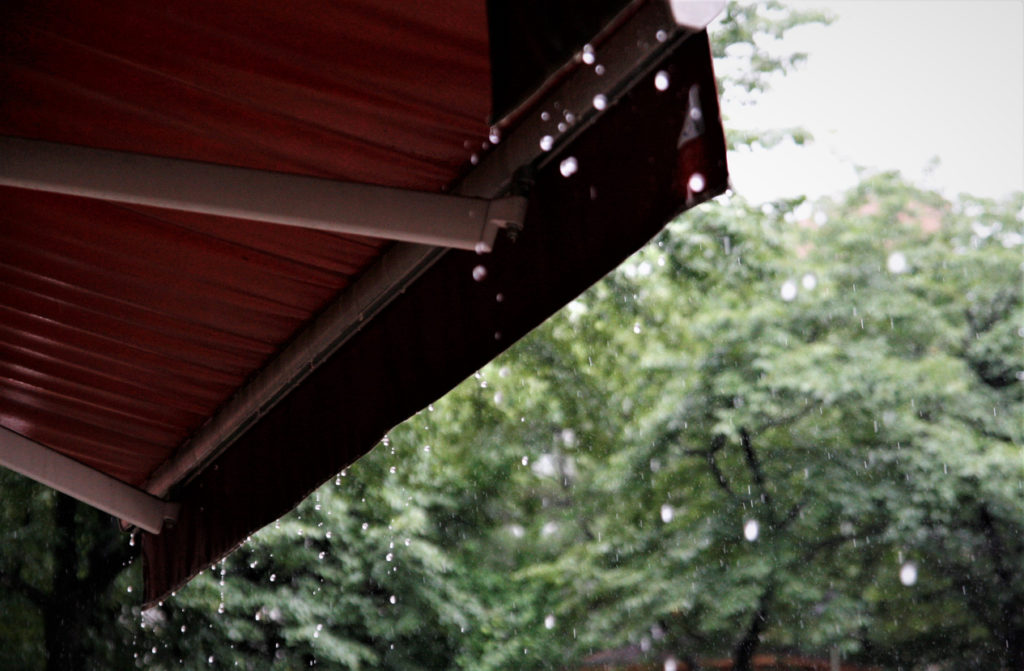

If you think the basement may be weepy or wet – see it on a day when it’s raining, preferably heavily, or see it just after a heavy rain.

If you think the house is noisy because it’s in close proximity to a commuting route, on a busy road or near a train line – see it during the peak morning or evening commuting times. (We did this when contemplating the purchase of our current home in Weston, MA 12 years ago. We wanted to make sure we were comfortable with the noise issues, and we ultimately decided that we were and bought the house.)

If you think a nearby school, baseball field or house of worship could affect the traffic congestion or parking around the house – see it when the school is letting out, the baseball game is in play or the church service is just about to begin.

If you think a restaurant or factory just a few doors down may emit foul-smelling odors – see it when the restaurant is serving dinner or the factory is operating in full swing.

I could go on and on…. The bottom line is that no house is perfect and that every house has its pros and cons. But when it comes to the cons, it’s prudent to make sure you see the home before purchasing it when the negatives are amplified or at their all-time worst. This way you’ll have fully researched and evaluated the property’s drawbacks and pitfalls so that there aren’t any surprises (or maybe more accurately said, so the surprises are minimized). If your new potential home is still appealing after seeing it at its worst, then you can have the confidence that it’s the right house for you. And on that positive note, I hope you enjoy the home-buying process, and I wish you the best of luck in finding the home that is right for you. Cheers!

What are your thoughts on the best time to see a house? Have you encountered some of these concerns about your potential new home and scheduled a second or third showing at a time when you could see it in its worst case scenario? And did you end up buying that particular house? I can’t wait to hear….

For more information on this or about the real estate market in Weston, Wellesley, Wayland and the surrounding towns or if you are considering selling your home, please contact me, Lisa Curlett (www.lisacurlett.com, 781-267-2844 or lisa.curlett@compass.com), to answer any questions or for a complimentary home appraisal.